What is the Average Credit Score by State?

August 21, 2024 | 2 min read

August 21, 2024 | 2 min read

According to the latest FICO data, the average credit score in the United States is 717 after holding steady at 718 for most of 2023. The average VantageScore is 702 as of June 2024.

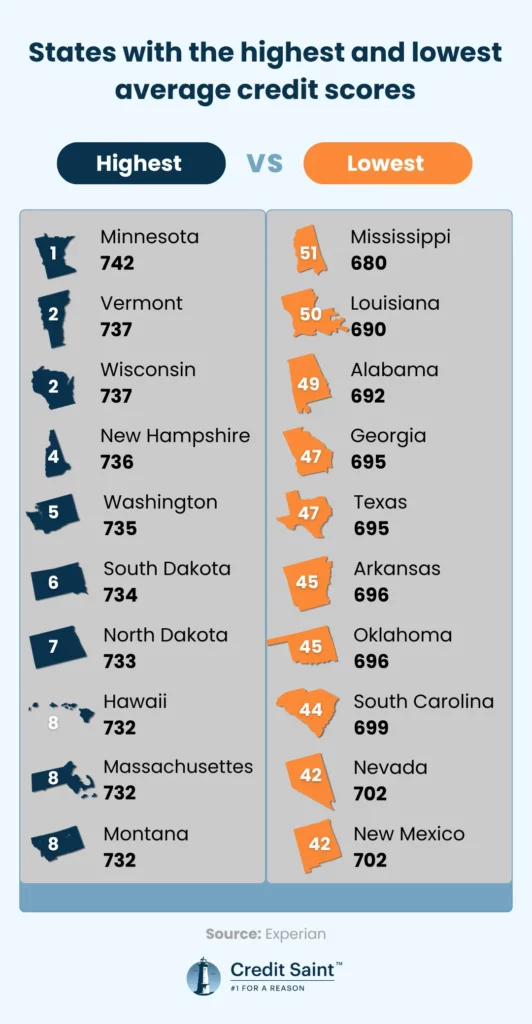

Overall, Americans have good credit, but Minnesota has the highest average credit score at 742, earning the only “Very Good” credit rating out of all 50 states and the District of Columbia. Mississippi, on the other hand, has the lowest average score at 680, which is considered “Good”.

If you’re wondering how your credit score compares to others’ in your state, you’re in the right place. The Credit Saint research team analyzed FICO Score data for all 50 states and the District of Columbia to give you the most up-to-date view of credit score averages across the country in 2024.

Read on to see which states have the best — and the worst — average credit scores, and get tips on how to improve your score no matter where you live.

| Key Takeaways |

|---|

|

Generally, a credit score above 670 is widely recognized by many lenders as a reliable indicator of good creditworthiness.

A good credit score demonstrates to lenders that you are a dependable borrower. Each lender sets its own standards for what it considers a good credit score and determines how to apply this score, along with other information, during the loan approval process.

Having good credit matters most when you’re making big money moves — like securing a home or auto loan, renting an apartment, applying for a credit card, or getting insurance coverage. Good credit can lead to more favorable interest rates and lower monthly payments.

It’s good to know where you stand so you can plan for building or repairing your credit if needed.

The top 10 states with the highest average credit scores include:

The bottom 10 states with the lowest average credit scores include:

Below is the full list of average credit scores across the U.S. by state, including how these scores have shifted from 2022 to 2023, using the most recent data from Experian®.

Improving your credit score doesn't have to be complicated. Here are some straightforward strategies that can help boost your score:

By sticking to these guidelines and monitoring your financial habits, you'll not only improve your credit score but also enhance your overall financial health.

Remember, a better credit score can open doors to lower interest rates and more favorable loan terms in the future.

Your credit score plays a critical role in your financial life, influencing everything from loan approvals to interest rates. Across the U.S., average credit scores vary significantly, with a 62-point difference between the highest in Minnesota (742) and the lowest in Mississippi (680). Whether your state ranks high or low, the key to improving your credit is consistent, responsible financial habits.

To elevate your credit score, focus on making timely payments, keeping credit balances low, and maintaining a long credit history. Regularly checking your credit report for errors and avoiding unnecessary new accounts can also make a significant difference.

By taking these steps, you can boost your score and unlock better financial opportunities, no matter where you live.

The Credit Saint research team gathered average FICO credit score data for each state from Experian’s 2023 Consumer Credit Review.

Fair Use Statement: You can share our findings for noncommercial purposes so others can see credit score averages across America. We ask that you provide a link back to this page so readers can access our full research and findings.

Reviewed By:

Ashley Davison

Editor

Ashley is currently the Chief Compliance Officer for Credit Saint, previously the Chief Operating Officer. Ashley got into the Financial world by working as a Logistics Coordinator at Ernst & Young. Coming from a previous career in education, she is eager to teach the world everything she knows and learn everything that she doesn’t! Ashley is a FICO® certified professional, a Board Certified Credit Consultant, a Certified Credit Score Consultant with the Credit Consultants Association of America, UDAAP certified, and holds a Fair Credit Reporting Act (FCRA) Compliance Certificate.